All Categories

Featured

State Farm representatives sell whatever from property owners to auto, life, and various other popular insurance coverage items. So it's very easy for representatives to pack services for discounts and simple plan administration. Numerous clients take pleasure in having actually one relied on representative deal with all their insurance coverage needs. State Farm supplies universal, survivorship, and joint global life insurance policy policies.

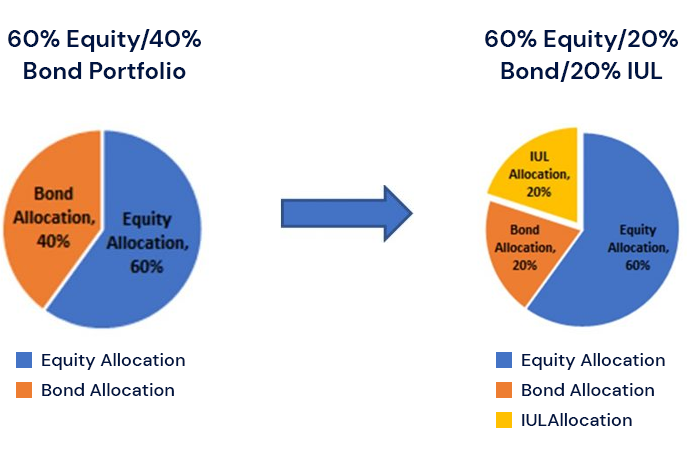

State Ranch life insurance coverage is generally conventional, using stable choices for the ordinary American household. However, if you're trying to find the wealth-building possibilities of global life, State Ranch lacks affordable choices. Read our State Ranch Life insurance policy review. Nationwide Life Insurance Policy markets all kinds of global life insurance coverage: global, variable global, indexed universal, and universal survivorship plans.

Still, Nationwide life insurance plans are very obtainable to American families. It assists interested parties get their foot in the door with a trustworthy life insurance coverage strategy without the much extra complicated conversations regarding financial investments, financial indices, and so on.

Nationwide fills up the essential duty of getting hesitant purchasers in the door. Even if the most awful happens and you can't obtain a larger plan, having the protection of a Nationwide life insurance coverage policy might change a customer's end-of-life experience. Read our Nationwide Life insurance policy review. Insurance provider use clinical examinations to assess your risk class when requesting life insurance coverage.

Buyers have the choice to transform rates every month based upon life scenarios. Certainly, MassMutual offers exciting and potentially fast-growing opportunities. However, these plans often tend to do best over time when early down payments are greater. A MassMutual life insurance policy representative or financial consultant can help customers make plans with room for adjustments to satisfy short-term and long-lasting financial goals.

Universal Life Insurance Broker

Read our MassMutual life insurance policy evaluation. USAA Life Insurance Policy is known for providing cost effective and extensive financial products to military participants. Some buyers might be surprised that it uses its life insurance policy policies to the public. Still, military members take pleasure in unique benefits. Your USAA policy comes with a Life Occasion Alternative biker.

VULs come with the greatest risk and one of the most possible gains. If your policy doesn't have a no-lapse guarantee, you might also shed coverage if your money worth dips listed below a certain limit. With so much riding on your financial investments, VULs call for continuous focus and upkeep. It might not be a great alternative for individuals that merely want a death advantage.

There's a handful of metrics through which you can judge an insurance business. The J.D. Power customer complete satisfaction rating is an excellent option if you want an idea of just how clients like their insurance coverage policy. AM Best's monetary strength rating is another crucial metric to consider when picking an universal life insurance policy firm.

This is especially important, as your money worth grows based on the financial investment choices that an insurance coverage company uses. You must see what investment options your insurance policy supplier deals and compare it versus the goals you have for your policy. The very best way to locate life insurance policy is to gather quotes from as numerous life insurance policy firms as you can to recognize what you'll pay with each policy.

Latest Posts

What Is Indexed Universal Life Insurance

Universal Life Insurance Rate

Term Life Vs Universal Life Insurance